|

|

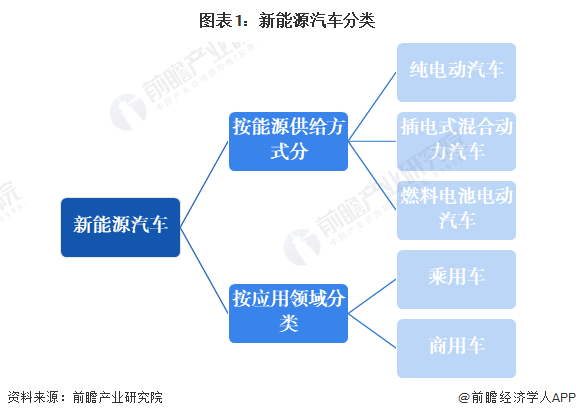

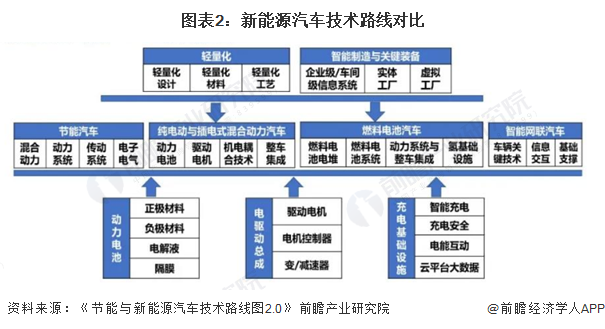

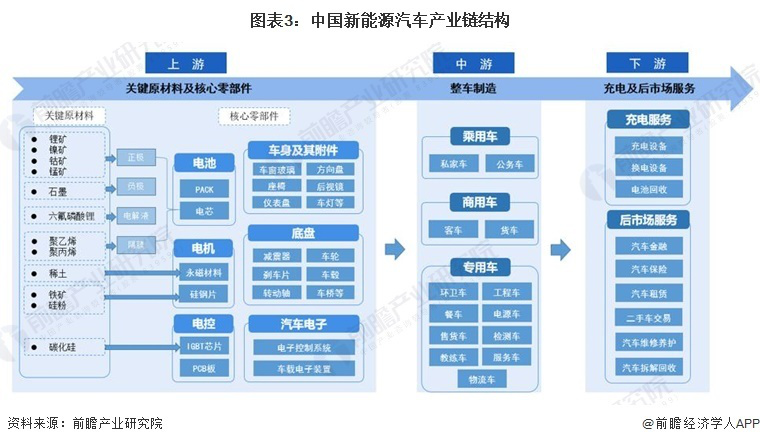

Foreseeing 2024: A Panorama of China's New Energy Vehicle Industry in 2024Industry Overview 1、Definition According to the National Economic Industry Classification (GB/T 4754-2017), new energy vehicles refer to automobiles that adopt new power systems and rely entirely or mainly on new energy sources to drive them, including plug-in hybrid (including programmable) vehicles, pure electric vehicles and fuel cell electric vehicles. The new energy vehicle industry refers to the collection of enterprises that carry out vehicle manufacturing activities for new energy vehicles. New energy vehicles are categorized in two ways according to energy supply and application areas, as follows: 2, new energy vehicle technology route comparison In October 2020, the Energy Saving and New Energy Vehicle Technology Road map 2.0 was officially released under the guidance of the Ministry of Industry and Information Technology and compiled by the Chinese Society of Automotive Engineering. From the perspective of "low-carbonization, informationization, and intelligence", the Road map compares and plans the technology routes of pure electric and plug-in hybrid vehicles, and fuel cell vehicles. Among them, the technical route of pure electric and plug-in hybrid vehicles mainly includes four modules: power battery, drive motor, electromechanical coupling technology and vehicle integration, while the technical route of fuel cell vehicles mainly includes four modules: fuel cell stack, fuel cell system, power system and vehicle integration, and hydrogen infrastructure. 3, industry chain analysis: the core technology is mainly concentrated in the battery link From the industry chain point of view, the upstream of the new energy vehicle industry chain mainly includes batteries, motors, electronic control and other core raw materials and parts supply; the midstream refers to the new energy vehicle manufacturing, according to the use of passenger cars, commercial vehicles, etc.; the downstream includes new energy vehicle charging services, new energy automotive after-market services and other application areas. Overall, the core competitiveness of new energy vehicles is reflected in the battery performance, therefore, the upstream battery manufacturing link is the core link of the new energy vehicle industry chain.

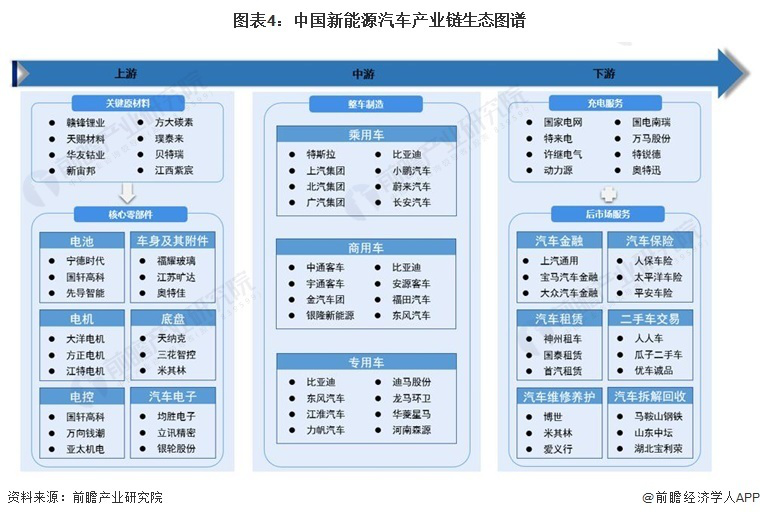

From the new energy automobile industry upstream and downstream industry chain participating enterprises, the upstream enterprises include Ganfeng lithium, Huayou cobalt and other raw material suppliers, as well as Ningde Times, Taiyo Yuden and other core parts suppliers; midstream of the new energy automobile manufacturers are mainly BYD, SAIC and other domestic enterprises, as well as Tesla, BMW and other foreign manufacturers; and the downstream mainly have the State Grid, SAIC-GM and other new energy automobile charging and after-market service providers. market service providers.

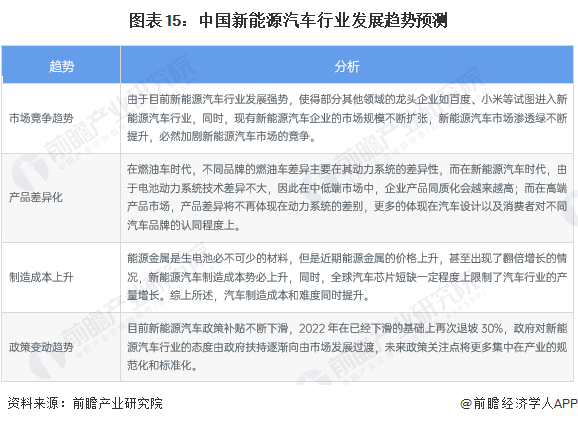

Industry Development History During the "Eighth Five-Year Plan" period, the government began to organize the relevant departments to carry out research and development of electric vehicles and key components; electric vehicles were then included in the national research projects. After a series of planning, started in 2011, the new energy vehicle pilot work in full swing, from the pilot to comprehensive, China's new energy vehicle industry is currently going through a transition phase, from "policy-oriented market" gradually to "market-oriented market "Transformation. Industry policy background As one of the important ways for the country to achieve "carbon neutrality", in recent years, the country has introduced various industrial policies to guide the new energy vehicle industry towards standardization and high-end development, promote the application of new energy vehicles in private and public services, encourage the transformation and upgrading of the new energy vehicle industry and improve quality and efficiency, which provides a good environment for the development of the new energy vehicle industry. Encouraging the transformation and upgrading of the new energy automobile industry and improving quality and efficiency have provided a favorable environment for the development of the new energy automobile industry. Industry Development Status 1, new energy vehicle production continues to grow Benefit from the policy preferential, China's new energy vehicle market from 2014 began to develop rapidly, new energy vehicle production and sales rose sharply; then in 2016, 2017 by the fraud incident and the impact of subsidy regression, production and sales growth slowed down. 2020 onwards, the new energy vehicle subsidy policy continued to regression, 2021 new energy vehicle subsidy standards will be in 2020 on the basis of a further 20% regression In 2022, the subsidy standard for new energy vehicles will be sloped back by 30% on the basis of 2021; the subsidy standard for vehicles that meet the requirements in the fields of urban public transportation, road passenger transportation, rental (including network car), sanitation, urban logistics and distribution, postal express, civil aviation and airports, as well as official duties of party and government organs, will be sloped back by 20% on the basis of 2021.2023 onwards, the new energy vehicles will no longer enjoy the subsidy. 2022, the annual output of new energy vehicles in China was 4.7 million. For the whole year of 2022, China's new energy vehicle output was 7.058 million vehicles, up 96.9% year-on-year. 2, new energy vehicle sales growth rate rebound According to the statistics of China Association of Automobile Manufacturers (CAAM), China's new energy vehicle sales exploded in 2022, reaching 6,887,000 units, up 93.4% year-on-year. 2012-2022, China's new energy vehicle sales from 12,800 units in 2012 to 6,887,000 units in 2022, realizing a leap forward, which can be seen that China's consumer's new energy vehicle Consumer demand is climbing year by year. 3、Rapidly rising penetration rate of new energy vehicles With the gradual development of the new energy vehicle industry, in 2014, China began to appear private purchase of new energy vehicles, which also opened China's new energy vehicle year. 2015, the country entered the new energy vehicle industry in the year of rapid growth, in November 2015, China's new energy vehicle production and sales in the overall automotive industry for the first time exceeded the 1% barrier, and our country has also become the world's largest new energy vehicle market in the past year. China also became the world's largest new energy vehicle market in this year. According to the latest data released by China Association of Automobile Manufacturers (CAAM), China's new energy vehicle market penetration rate (national new energy vehicle sales accounted for the proportion of total national vehicle sales) reached 27.6% in 2022, a significant increase from 2021. 4, new energy vehicle market size continues to expand From the perspective of market sales scale, in recent years, China's new energy automobile market has been developing rapidly, and the market scale has continued to grow. According to Statista statistics, from 2017 to 2022, China's electric vehicle market size grew from $30.77 billion to $160.43 billion, which translates into about 207.70 billion yuan to 1077.89 billion yuan according to the average exchange rate of the corresponding year. Among them, from 2020 to 2021, China's new energy vehicle market ushered in explosive growth, with a growth rate of 150.13%. from 2021 to 2022, affected by the new crown epidemic, the domestic new energy vehicle production side and consumption side both performed poorly, China's new energy vehicle market scale growth slowed down, and the growth rate of China's new energy vehicle market scale in 2022 was 7.85%. Industry Competition Pattern 1, regional competition pattern: the eastern region of new energy vehicle sales in the lead From the point of view of the sales of new energy vehicles in various provinces and cities, in 2022, Guangdong Province has the most sales of new energy vehicles, reaching 753,000 units, followed by Zhejiang, with sales of 621,400 units. Jiangsu Province ranks third with 482,200 units. Overall, the eastern region of China's new energy vehicle sales in the front, the northwest sales are relatively cold, these areas of new energy vehicle penetration rate still has a large space for improvement. 2, enterprise competition pattern: BYD market share is the largest. In 2022, China's new energy vehicle industry, the largest market share of enterprises for BYD, market share reached 31.7%, far more than other brands. SAIC-GM-Wuling and Tesla's share in China is 7.8%. As for the new car-making forces, the combined market share of Azure, Xiaopeng and Ideal reached 6.9%, which is still a low percentage. Industry development prospects and trend forecast 1、Policy retreat, competition intensifies With China's new energy policy subsidies retired, the market entered the transition stage, the future trend of China's new energy automobile industry is as follows:

2, the future sales of new energy automobile industry still has further room for improvement In October 2020, the State Council issued the "New Energy Vehicle Industry Development Plan (2021-2035)", which made it clear that by 2025, the new vehicle sales of new energy vehicles accounted for about 20%. According to the forecast of China Association of Automobile Manufacturers, China's auto sales will reach 30 million in 2025, and according to the "Work Program for Stable Growth of the Automotive Industry (2023-2024)" issued by the Ministry of Industry and Information Technology in September 2023, it is planned that China's new energy vehicle sales in 2023 will strive to reach 9 million units. |