|

|

The path to breakthrough for charging piles: High-power fast charging is to electric vehicles what 5G is to the internetIn the midst of all the heat and noise in China's charging pile market, Chinese charging pile companies were poured with cold rain: on February 15, the United States officially released new regulations for electric vehicle charging facilities across the United States, requiring that all federally funded charging piles must be produced in the United States and that at least 55% of the cost of charging pile parts come from the United States starting in July 2024. The following day, the A-share charging pile concept stocks collectively adjusted. Dao Tong Technology, Torch China Technology, Sheng Hong shares, etc. once fell more than 10% during the day. This is following last year's demand for 100% local production of electric vehicles and 50% localization of battery components, and now the U.S. government has once again stepped into the charging pile business. The charging pile sector has undoubtedly become a new focus of competition for the world's major powers. Following in the footsteps of the new energy vehicle industry, the growth and priority of charging piles is becoming more and more prominent, but new anxieties are following - in addition to the aforementioned outbound haze, there is a constant inward roll at the domestic end. A more important question arises: How can China's charging pile industry break through the "cold rain" and the inward roll?

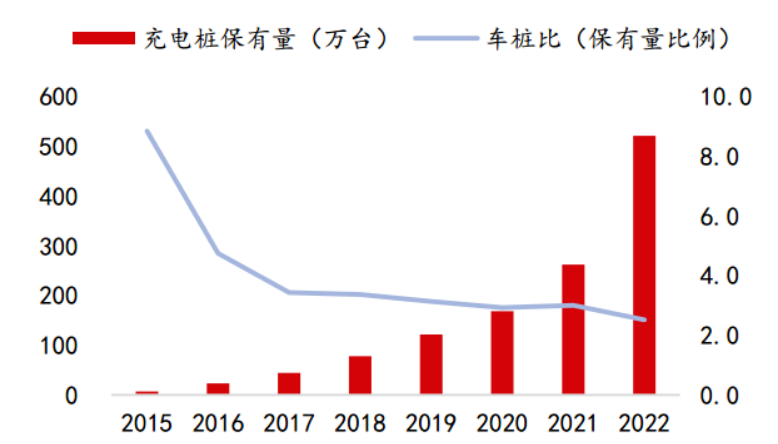

01 Universal demand and hundred billion track 1��Charging piles have become a national need The development of the global new energy vehicle industry has exceeded the expectations of most people, and now even the United States, which is wavering on electrification, has taken the initiative to step on the electric door and drive into the fast lane. According to IEA forecasts, the number of new energy vehicles in the US will reach 11 million by 2025, according to the calibre of policies already announced by the US government. On the other side of the coin, as a "refuelling station" for new energy vehicles, accelerating the construction of charging pile infrastructure has become a prerequisite and urgent need for the sustainable development of the global new energy industry. In order to support the charging pile industry, China included charging piles in the new infrastructure category in March 2020. Since then, the development of charging piles has reached a new stage. By 2022, the national charging infrastructure holdings reached 5.21 million units and the vehicle-pile ratio dropped to 2.6, i.e. 1 charging pile for every 2.6 new energy vehicles could provide services. Time came in February this year, the Ministry of Industry and Information Technology issued a "notice on the organization of the pilot work of the comprehensive electrification of vehicles in the public sector in the early area", again supporting the charging pile industry, the new policy proposed to improve the proportion of new energy vehicles in new and updated vehicles in the pilot area, public transport / rental / sanitation and other areas strive to reach 80%; new public charging pile / new energy vehicle promotion number ratio strive to reach 1:1.

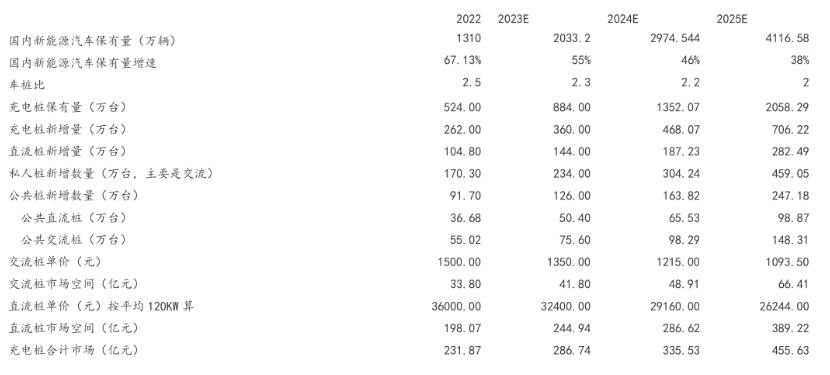

Figure 1: China's vehicle-pile ratio is on a significant downward trend, Source: China Charging Alliance, Guolian Securities Also in 2020, the European Union introduced the Green Transformation Plan for Transport Systems, proposing to deploy about one million public charging piles across Europe by 2025 and planning to build three million public charging piles by 2030. Governments have been issuing financial subsidies and investment plans for the construction of charging pile facilities, and the United States is not far behind. In February last year, the US Department of Energy and the Department of Transportation announced a subsidy of around US$5 billion over the next five years for the construction of a US-wide fast charging network. However, compared to the speed of China, the charging pile gap is still large in overseas regions and the construction of charging piles is already imminent. In the United States, for example, the penetration rate of new energy vehicles is rising rapidly, while the charging pile supporting facilities have been seriously lagging behind, and its car-pile ratio is as high as 17:1. This means that the global charging pile industry will usher in a round of construction tide. 2��Market space estimation The development of new energy vehicles is closely related to the growth process of charging piles, and the growth space of charging piles is the nerve of the majority of new energy investors. According to the estimation of Anxin Securities, by 2025, the market space of charging pile in China will reach 45.5 billion yuan. Looking at the global market, the market size of charging piles is expected to reach 100 billion.

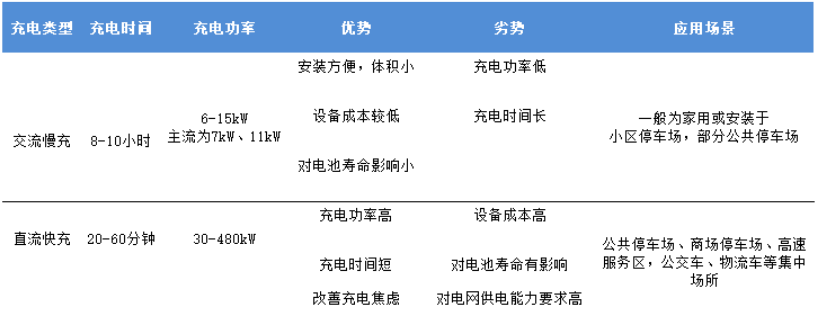

Figure 2: Estimated market space in the domestic charging pile industry, Source: CPSC, Anxin Securities 02 The road to breakthrough and thorns on the road 1. High-power fast charging has become the new favourite Whether it is a community, a shopping mall car park or a roadside, more and more charging piles are being built, but charging anxiety still plagues new energy vehicle owners. The main reason behind this is that new energy vehicle sales are also growing at a high rate, and the amount of electricity carried by a single vehicle is continuing to increase. According to the International Energy Agency, the amount of electricity carried by a pure electric vehicle will rise to around 80kWh by 2025, nearly 1.6 times the amount carried by 2022. From the user's perspective, it is clear that the convenience of charging piles is still a long way from being a true 'infrastructure'. How can the gap be quickly reduced? The only martial art under the sun is speed. This is the right phrase for charging piles today. According to the charging method, charging piles can be divided into AC charging piles and DC charging piles. The former is also known as the slow charging pile, where the charging process often takes 6-8 hours or even longer; the latter is what we call the fast charging pile, which can generally be charged up to 80% in half an hour. Compared to slow charging piles, high power fast charging piles have the advantages of high power and fast charging, which can significantly reduce charging time. The average service capacity of a charging station of the same size is much higher, which can effectively make up for the lack of charging piles. (If you encounter an oddball model like the Toyota bZ4X, which takes 7 hours to charge even fast, this needs to be discussed separately)

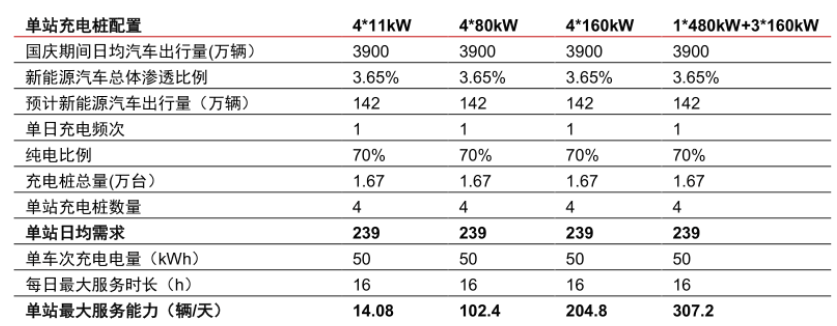

Figure 3: Comparison of DC piles and AC piles, Source: Compiled by Jindan Research Institute based on public information Taking the high-speed scenario of holidays, which is the biggest concern for new energy vehicle owners, as an example, the advantages embodied by high-power fast charging will be more intuitive. According to CITIC Securities' calculations, for the same charging station equipped with 4 charging piles, a high-power charging pile equipped with 1*480kW + 3*160kW can increase the average daily service capacity from 14 to 307 vehicles for 4*11kW AC piles, with basically the same land occupation.

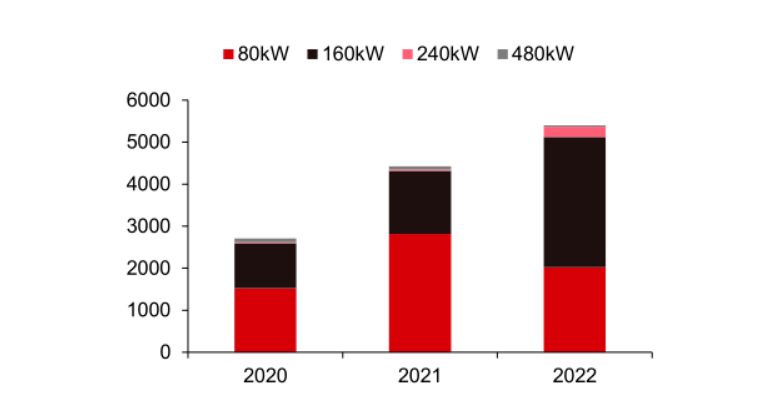

Figure 4: Charging station service capacity measurement - taking holiday highway scenario as an example, source: CITIC Securities' calculations According to the "Energy Saving and New Energy Vehicle Technology Roadmap 2.0" released in 2020, in terms of time nodes, in 2035, high-power fast charging should achieve the goal of charging 5min to drive more than 300km. By that time, the charging of new energy vehicles will be almost comparable to the refuelling of fuel vehicles, truly realising that charging is the only way to go. In a sense, the importance of high-power fast charging for the new energy vehicle industry is comparable to that of 4G and 5G networks for the internet industry. For this reason, high-power fast charging is becoming a competitive high point for all players. Since 2020, the number of DC pile bids from power operators such as the State Grid has increased significantly while the proportion of charging piles with a power of 160kW or more has grown significantly, and higher power charging pile power has become the most real demand from users.

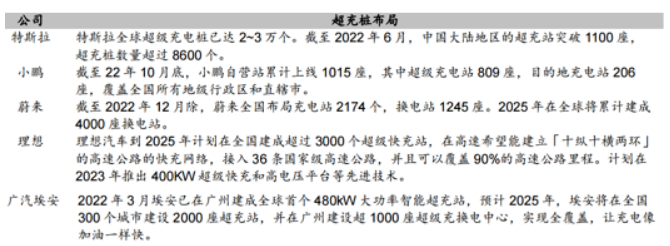

Figure 5: Number of state grid charging and switching equipment purchases (sets), 2020-2022, Source: Development and Reform Commissions and Energy Bureaus around the world, CITIC Securities At the same time, mainstream car companies are actively laying out high-power fast charging. More than 10 domestic automakers have announced the development of 800V high-voltage platforms, intending to seize the new high ground of high-power fast charging. Xiaopeng, RISO and GACEAN are accelerating the promotion of super-charging station construction to form differentiated competition. For example, the S4 supercharging pile of Xiaopeng Automotive, which will go live in August 2022, has reached a peak charging power of 400kW for a single pile, allowing for 5 minutes of charging and a 200km increase in range. In fact, when charging anxiety replaces mileage anxiety, having supercharging stations has become one of the labels for car companies' competitiveness. Back then, Musk insisted on laying out his own charging system and vigorously developing high-powered fast-charging technology, eventually launching Tesla's owners-only supercharging stations. In retrospect, the improved charging experience brought about by Tesla's supercharging stations has in turn boosted Tesla's vehicle sales and brand power building, leading the way to a positive cycle. To date, Tesla has built and opened more than 1,400 supercharging stations in mainland China, leading the industry; Xiaopeng, with more than 800 of its own supercharging stations, is close behind, and other car companies are accelerating to catch up.

Figure 6: Layout of high-power fast-charging piles in some domestic car companies, source: Shanghai Securities In summary, high-power fast charging is undoubtedly one of the simplest and most brutal ways to ease charging anxiety. But then again, while high-power fast charging is the object of much debate, it poses huge challenges to the stability and safety of the power system, and must be taken seriously. The first is that high power fast charging brings greater impact to the distribution network. This is because the power electronics in charging equipment will generate harmonics that can cause power quality problems. This is especially true for the 800V super fast charging scenario, where the charging power is up to 480kW, which is 4-6 times higher than the current mainstream DC fast charging piles. Secondly, due to the uncertainty and randomness of charging for new energy vehicle users, this will increase the difficulty and frequency of grid optimisation and control. As a simple example, when a large number of new energy vehicles are charged during peak periods, this will further exacerbate the peak-to-valley load differential on the grid, increasing the burden on the power system, and in severe cases even causing power shortages. As the number of new energy vehicles increases, the increase in electricity consumption will be visible to the naked eye. The contradiction between the construction of high-powered fast-charging piles and the power system will intensify. According to the calculation of 30 million electric vehicles in 2024, assuming that each vehicle consumes 10 degrees of electricity per day, that is, 300 million degrees of electricity will be consumed in a day, which is basically equivalent to the power generation of the Three Gorges Dam.

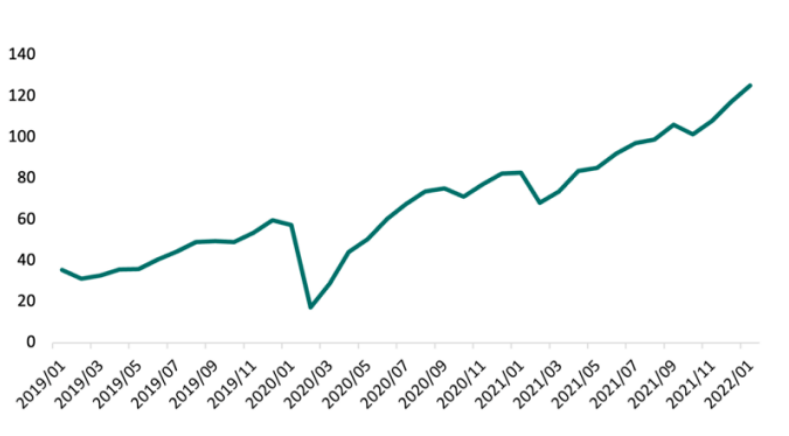

Figure 7: Rapid growth of public charging pile charging volume (10 million kwh), Source: China Charging Alliance, Yingda Securities In short, an electrical system that is more attuned to the use scenario of new energy vehicles becomes a guarantee of the reliability and adaptability of high-power charging piles, just as new energy vehicles rely on charging piles, and none of them are independent systems; all three become an inseparable organic union of the new energy network. It is not difficult to find that they are mutually supportive, mutual achievement. 2. The road to overseas gold is long and difficult Similar to the development path of other industries, going abroad for gold has become the preferred path of domestic charging pile enterprises. After all, domestic charging pile enterprises have comparative advantages in technology and cost end. Using data to speak, charging pile enterprises in the domestic gross margin level of about 20%-30%, while the overseas market up to 30%-40%. Along with the overseas charging pile construction into the golden development period, more and more charging pile enterprises tend to rush. However, it is not an easy task for charging piles to go to sea. First of all, the high cost and long period of overseas certification directly dissuaded many small and medium-sized enterprises. Up to now, Shenghong, Daotong Technology, Torch China Technology, Xiangshan and other head companies with earlier overseas layouts are the first to obtain a number of overseas certifications and gradually achieve product delivery. Secondly, overseas sales channel construction, due to the lack of domestic enterprises in overseas brand power and after-sales maintenance links, etc., more is relying on overseas cooperation, such as the AC pile products of Dao Tong Technology through Costco, BestBuy and other super channel sales. In short, Chinese charging pile enterprises are still in the primary stage of the road to the sea. According to Ali International Station cross-border index shows that, up to now, China's charging pile export markets are mainly developed regions in Europe and the United States. The United States, a country on wheels, was once treated as one of the most promising markets, and the introduction of new policies in the United States is undoubtedly to the sea of the charging pile enterprises a blow to the head. In order to fight for the US market, building local factories or seeking cooperation with OEMs is an effective path for Chinese charging pile companies to circumvent policy restrictions. It remains to be seen whether Downtone Technology, which plans to set up a factory in the US in 2023, can give Chinese charging pile companies a good start. 03 Are charging piles still a good business? 1. Supply side - serious homogenization in China For investors, the first question to consider is: is the charging pile a good business? Compared to lithium battery production and vehicle manufacturing, the industry threshold for charging piles is relatively low, with fast capacity expansion, low investment and short construction cycle. Nowadays, more and more companies continue to pour in, trying to get a share of the pie. However, the reality is skeletal. Charging pile industry through the pre-barbaric growth, the current number of domestic charging pile equipment manufacturers more than 300, serious homogenization, industry competition white-hot... In other words, the other side of the 100 billion dollar charging pile track is actually a highly competitive red sea. Overcapacity and industry reshuffling have become an irresistible trend. 2. Still relying on subsidies Like the electric car industry, the construction and development of charging piles has been inseparable from the support of policies. As the domestic charging pile construction long-term policy-oriented, resulting in charging pile geographical imbalance problem highlighted. The charging piles in the regions where new energy takes the lead and the first-tier cities have a higher proportion of charging piles, with the TOP 10 regions such as Guangdong, Jiangsu, Zhejiang, Shanghai and Beijing building more than 70% of the public charging piles. In contrast, third-tier cities and below, including rural areas and towns, are significantly behind in the construction of charging piles in these areas, and the coverage rate is far from adequate.

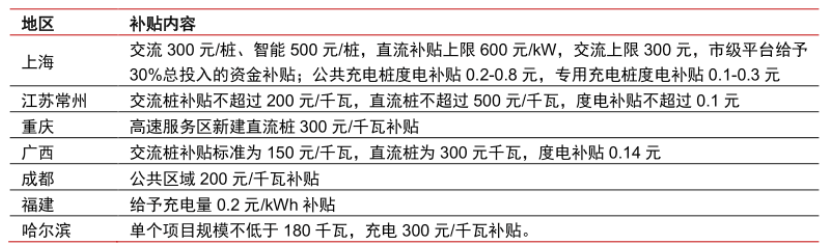

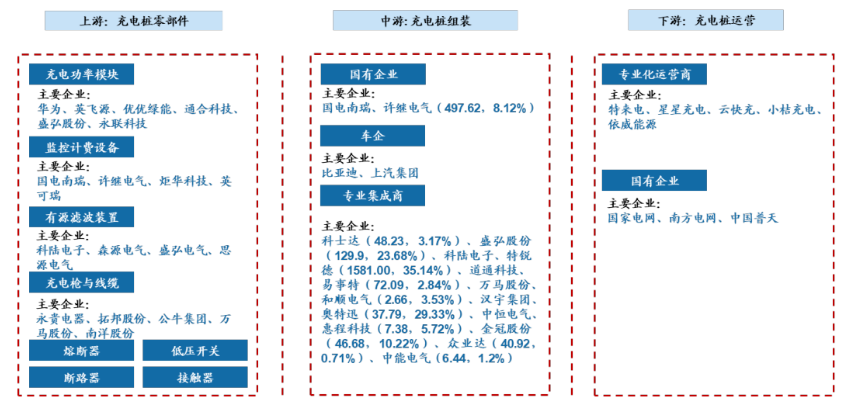

Figure 9: Subsidy policies in some regions since 2022, Source: Development and Reform Commissions and Energy Bureaus around the world, CITIC Securities Looking at overseas regions, subsidy policies are equally strong drivers for charging pile construction. After all, these are real money concessions. Although the subsidy policy for charging piles varies from country to country in Europe, the average subsidy for a private pile can be around �900, with the subsidy ratio reaching around 50% of the cost of the equipment. Italy, for example, has an aggressive policy of rebating 50% of the cost of its private charging piles, with a cap of �2,000. Entering 2023, new energy vehicles officially entered the "post-subsidy era", the charging pile is still in the process of transformation from policy-driven to market demand-driven. It is easy to see that the seemingly simple business of charging piles is not a good one. 3��Who is the beneficiary? The upstream of the charging pile industry chain is the parts manufacturing link, the midstream is the charging pile assembly link, and the downstream is the operation link. The higher the charging voltage of the charging pile, the higher the power, the higher the requirements for manufacturing technology and construction operation and maintenance.

Figure 10: Top 10 charging operators for public charging piles in 2022, Source: Wind, GF Securities The upstream components of charging piles mainly include: charging modules, monitoring units, lightning protection units, fuses, relays, and external structures including charging guns, housings, displays, etc. Among them, the charging module is the most important beneficiary link under the development trend of high-voltage and high-power charging pile. From the cost perspective, the charging module accounts for 40%-50% of the cost of the charging system. The trend of high power and high voltage brings an increase in the value of the charging module. From the technical point of view, the charging module, as a key component of the charging pile, is mainly responsible for circuit control, conversion and ensuring circuit stability, which is directly related to the overall performance of the charging pile and charging safety. With the increase of voltage level and charging level, the charging module needs to have higher high voltage resistance and power density, which to a certain extent raises the technical threshold of the charging pile. In addition, high-power charging naturally brings a significant increase in thermal effects, and the thermal management of charging piles is gradually evolving from air-cooled to liquid-cooled, with devices such as liquid-cooled products being a new increment for component companies. Speaking of charging pile operators again, this is closely related to new energy vehicle owners. Since the State Grid opened the charging infrastructure market to social capital in 2014, private enterprises have gradually become the main players. By the end of 2022, the top three operators of public charging piles in China, namely Tesco, Star Charging and Cloud Fast Charging, were all private enterprises. In everyone's traditional perception, private enterprises have an inherent advantage in terms of profitability. However, private charging pile operators are still unprofitable even when they are at the head of the industry. At the root of this, the main source of profit for charging pile operators is charging service fees, but the utilization rate of charging piles is generally around 5%, which means that charging piles are idle most of the time, which is the main reason for losses. Specifically, charging piles are often unevenly used, with some locations experiencing low usage of the charging infrastructure and some charging infrastructure experiencing queues for vehicles to be charged. This has led to a lack of effective use of operators' charging pile resources and has limited the enthusiasm of users to use public charging piles. In the past two years, head companies such as Tesco and Star Charging have become more rational in their choice of charging sites, seeking to "save themselves". It is worth looking forward to the trend of high-powered fast charging, which can quickly improve the service efficiency of charging piles and drive up the utilization rate of charging piles, which is expected to repair the profitability of operators. In turn, the improved profitability of operators will inspire confidence in the layout of charging piles. |