|

|

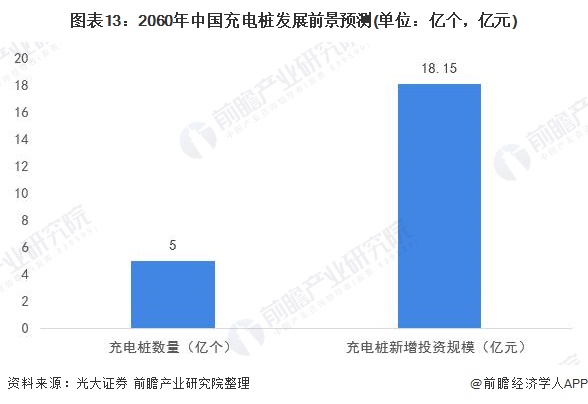

Foresee 2021: A Panoramic Map of China's EV Charging Pile Industry in 2021In recent years, under the dual role of policy and market, domestic charging infrastructure has advanced rapidly and formed a good industrial foundation. By the end of March 2021, there were 850,890 public charging piles in China, and the total number of charging piles (public and private) totaled 1.788 million. In the context of efforts to achieve "carbon neutrality", China will urgently develop new energy vehicles in the future. The steady growth of new energy vehicles will promote the expansion of the demand for charging piles. It is expected that by 2060, China's new investment in charging piles will reach 1.815 billion yuan.

Ac charging piles account for the highest proportion, reflecting the application scenarios of charging piles

Ev charging piles are charging devices installed in public buildings (public buildings, shopping malls, public parking lots, etc.) and parking lots or charging stations in residential communities to provide power guarantee for various types of EV according to different voltage levels.

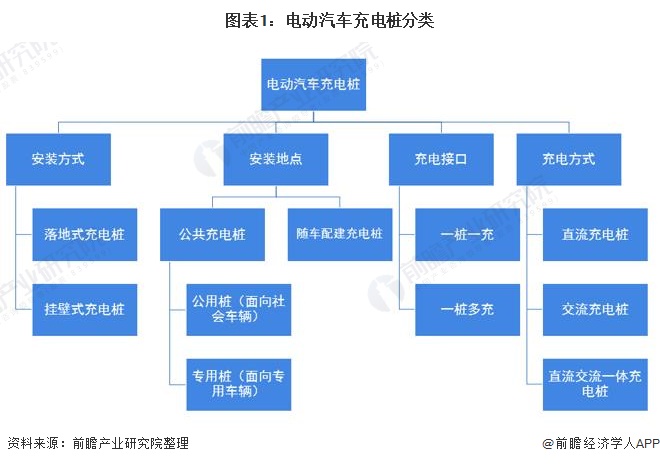

Ev charging piles can be divided into floor-type charging piles and wall-mounted charging piles according to the installation mode. According to the installation location, it can be divided into public charging piles and charging piles with vehicles; Public charging pile can be divided into public pile and special pile, public pile for social vehicles, special pile for special vehicles; According to the number of charging interface can be divided into one pile one charge and one pile multiple charge; According to the charging pile charging mode, it can be divided into DC charging pile, AC charging pile and AC/DC integrated charging pile.

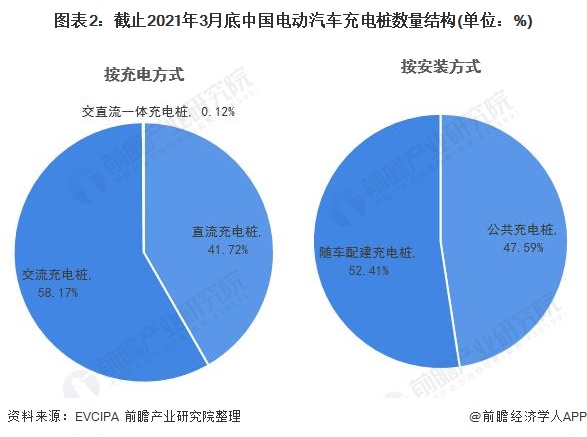

According to the latest statistics from EVCIPA, the number of AC charging piles in China reached 495,000 by the end of March 2021, broken down by charging methods. Accounted for 58.17%; The number of DC charging piles was 355,000, accounting for 41.72%; Ac and DC integrated charging piles were 481, accounting for 0.12%.

By the installation location, by the end of March 2021, the number of charging piles installed with vehicles in China reached 937,000, accounting for 52.41%. There were 851,000 public charging piles, accounting for 47.59 percent.

From this point of view, ev charging piles in China are mainly AC charging piles and charging piles with vehicles. Ac charging pile, commonly known as "slow charging", is fixedly installed outside electric vehicles and connected with the AC power grid to provide AC power for the on-board charger of electric vehicles (i.e. the charger fixedly installed on electric vehicles).

The combination of the two reflects the application scenarios of ev charging piles in China. More and more car owners also choose more convenient and free private places to charge, and choose slow charging piles with low battery loss to charge their vehicles.

The mid-stream charging operation costs are high and the market concentration is high

The industrial chain of ev charging piles involves manufacturers of upstream charging piles and equipment required for the construction and operation of charging stations, including major material suppliers and charging equipment manufacturers of charging piles and charging stations such as shells, bases and cables.

The middle stream is the charging operator, responsible for the construction and operation of charging piles and charging stations;

The downstream is the overall solution provider, providing charging pile location service and booking payment function or charging pile operation management platform and solution, which can coordinate the upstream and downstream and customer needs, and provide the overall operation plan with reasonable layout.

In the electric vehicle charging pile industry chain, midstream charging operators are difficult for potential entrants to enter the industry, because the cost of midstream is high and certain financial strength is needed. According to relevant statistics, charger and charging module are core charging equipment, accounting for 45%-55% of the total cost of charging facilities.

Among them, charging module and charger account for 51.76% of the cost of charging system. The investment cost of building a charging station is 2.5 million yuan, and the cost of power distribution facilities is about 1.6 million yuan.

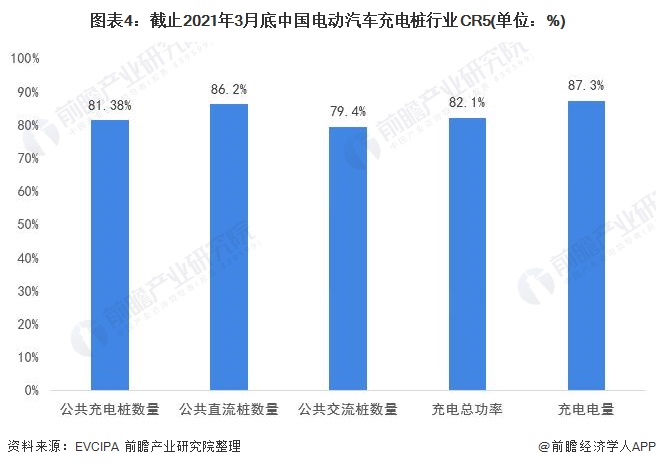

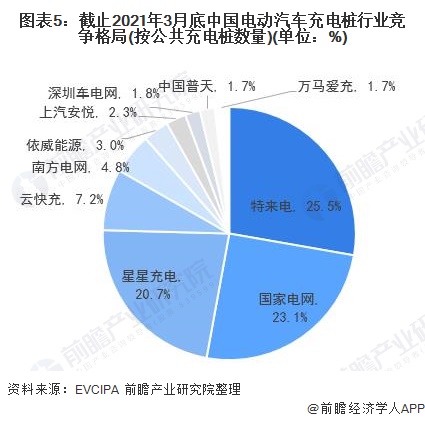

At the same time, China's ev charging pile market concentration is high. By the end of 2020, there were only 25 large-scale operators (with more than 100 charging stations) in China. By the end of March 2021, the top five operators all occupied more than 79% of the market share in terms of the number of public charging piles, the number of dedicated charging piles, the number of DC piles, the number of AC piles, and the total charging power and charging quantity.

On the whole, SPECIAL call, State Grid and Star Charge occupy the main market share, with the number of public charging piles accounting for more than 20%. Among them, special call has the largest number of 217,054 public charging piles, accounting for 25.5%. The number of public charging piles of State Grid and Star Charging was 196,484 and 176,367, accounting for 23.1% and 20.7% respectively.

Downstream application demand expansion, policy dividend release to promote

The development of ev charging pile industry is inseparable from the continuous expansion of downstream demand and the guidance of national policies.

-- Sales of new energy vehicles are climbing

After more than 10 years of development of China's new energy vehicle industry, consumers' recognition of electric vehicles continues to improve. Moreover, the new energy vehicle industry has shifted from being completely driven by policies to being driven by policies and the market.

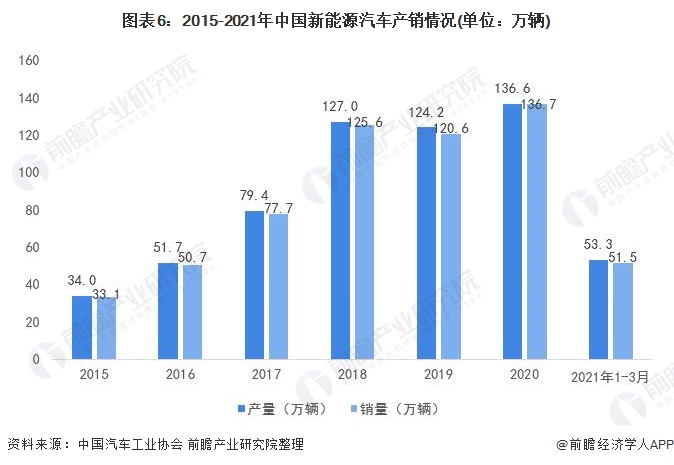

According to the China Association of Automobile Manufacturers, the domestic production and sales of new energy vehicles were 1.366 million and 1.367 million respectively, with year-on-year growth of 9.98% and 13.35% respectively.

In the first three months of 2021, the output and sales of new energy vehicles in China were 533,000 and 515,000, up 3.2 times and 2.8 times year-on-year, respectively. The production and sales of pure electric vehicles were 455,000 and 433,000, up 3.6 times and 3.1 times year-on-year, respectively.

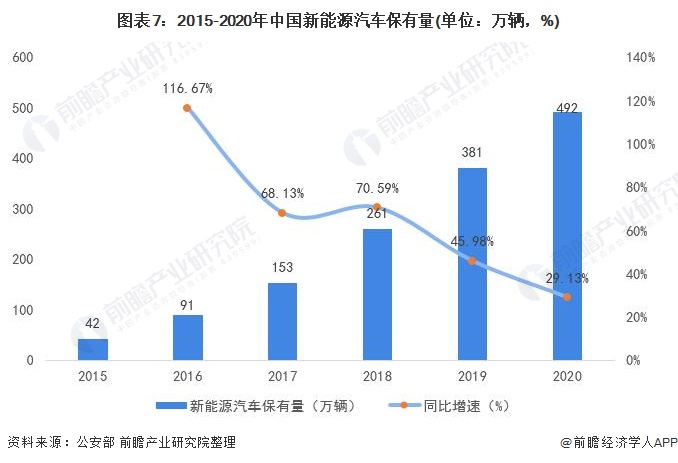

In terms of ownership, by the end of 2020, there were 4.92 million new-energy vehicles in China, up 29.13% year on year. The demand and possession of new energy vehicles are further growing, and the demand for electric vehicle charging piles is also expanding.

-- National policy guidance and promotion

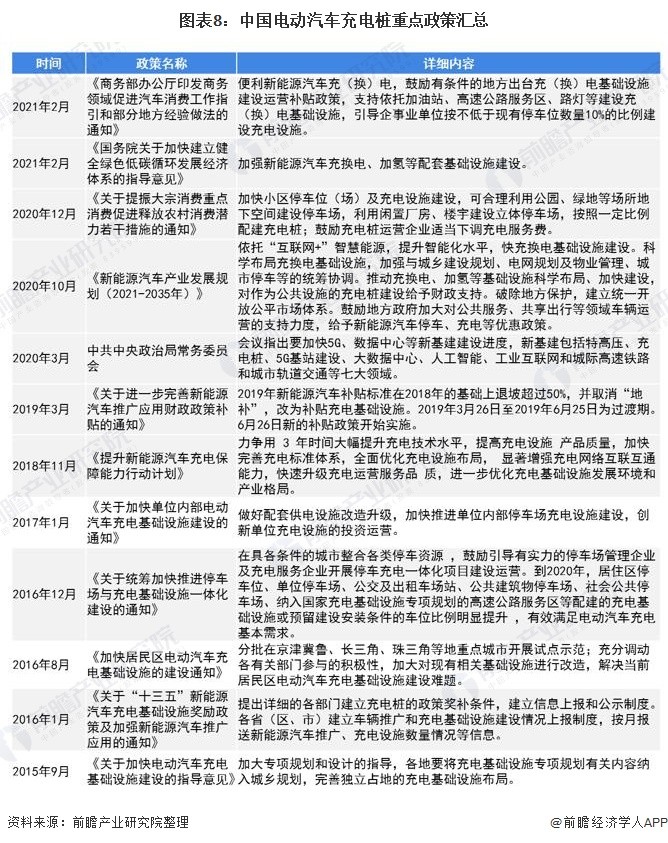

The rapid development of domestic charging pile is inseparable from the promotion of relevant policies. No matter for the infrastructure construction of consumers, or for the relevant work carried out by institutions and institutions, the policies in recent years have covered the construction of charging infrastructure, power access, and charging facility operation, playing a crucial role in mobilizing relevant resources of the whole society to promote the development of charging infrastructure.

In September 2015, The General Office of the State Council issued the Guiding Opinions on Accelerating the Construction of Electric Vehicle Charging Infrastructure, which clarified the policy direction of the charging pile industry for the first time. Subsequently, relevant national departments have issued policies to promote the construction of charging piles in residential areas, office areas and public areas, which has made many restrictions on the impact on technological level, public transportation and official vehicles, and also promoted the development of electric vehicle charging piles in China.

-- National policy guidance and promotion

The rapid development of domestic charging pile is inseparable from the promotion of relevant policies. No matter for the infrastructure construction of consumers, or for the relevant work carried out by institutions and institutions, the policies in recent years have covered the construction of charging infrastructure, power access, and charging facility operation, playing a crucial role in mobilizing relevant resources of the whole society to promote the development of charging infrastructure.

In September 2015, The General Office of the State Council issued the Guiding Opinions on Accelerating the Construction of Electric Vehicle Charging Infrastructure, which clarified the policy direction of the charging pile industry for the first time. Subsequently, relevant national departments have issued policies to promote the construction of charging piles in residential areas, office areas and public areas, which has made many restrictions on the impact on technological level, public transportation and official vehicles, and also promoted the development of electric vehicle charging piles in China.

Under the dual role of policy and market, domestic charging infrastructure has advanced rapidly and formed a good industrial foundation. By the end of March 2021, there were 850,890 public charging piles in China, and the total number of charging piles (public and private) totaled 1.788 million. Policy support and related fiscal subsidy policies have greatly promoted the development of charging infrastructure construction by the government and enterprises.

Local response to accelerate the layout, the future development of intelligent

-- Some cities have increased subsidies, and Guangdong ranks first in construction scale

In response to the national call, local governments have launched various policies and plans related to electric vehicle charging facilities to promote the development of charging facilities from the central to the local. By the end of March 2021, a total of 30 provinces across the country had issued plans for policies related to charging facilities.

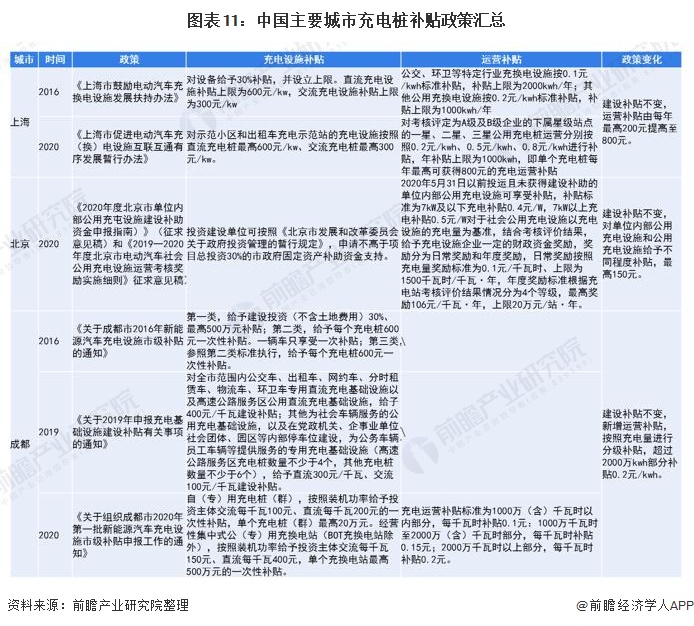

At the same time, along with the inclusion of charging piles into new infrastructure, cities also increased their subsidies for public charging pile operation on the basis of facility subsidies. In Shanghai, the subsidy for public charging pile operation increased from the maximum of 200 yuan/KWH · year in 2016 to the maximum of 800 yuan/KWH · year in 2020.

Beijing will provide construction subsidies of up to 500 yuan/kW for internal public charging facilities that are put into operation before May 31, 2020 and do not receive construction subsidies, and 0.1 yuan/KWH for the operation part, with an annual subsidy cap of 1,500 KWH.

In 2020, Chengdu will provide graded subsidies for the operation of public charging piles based on the charging volume. The subsidy is 0.1 yuan/KWH within 10 million KWH, 0.15 yuan/KWH for 10-20 million KWH, and 0.2 yuan/KWH for more than 20 million KWH.

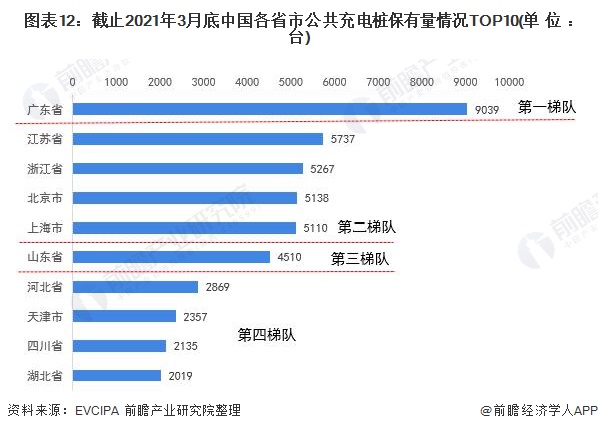

By the end of March 2021, Guangdong province had the most public charging piles, with 9,039 units, far ahead of other provinces. Jiangsu, Zhejiang, Beijing, Shanghai, Shandong, Hebei, Tianjin, Sichuan and Hubei are also among the top 10 provinces for holding public charging piles.

Jiangsu, Zhejiang, Beijing and Shanghai are in the second tier, with more than 5,000 public charging piles. Shandong province is in the third tier, with 4,510 charging piles. Hebei, Tianjin, Sichuan and Hubei are in the fourth tier.

-- In the context of "carbon neutrality", the country is promoting the development of new energy vehicles, and the future demand for charging piles is large

At the beginning of the "14th Five-year Plan", the country proposed the development of carbon neutral, the promotion of new energy vehicles will effectively optimize China's energy structure, help to achieve carbon neutral economy. Therefore, the future of the country will be urgent to promote the development of new energy vehicles. With the growth of the number of new energy vehicles in China in the future, the demand for charging piles will further expand.

Assuming that the vehicle-pile ratio in China reaches 1:1 in 2030, the total number of charging piles will exceed 500 million in 2060. Taking into account the demand for new construction and replacement of charging piles, the cumulative additional investment is expected to reach 18.15 trillion yuan.

-- The five modernizations will be implemented in the future

In addition, with the gradual promotion and industrialization of electric vehicles and the increasing development of electric vehicle technology, the technical requirements of electric vehicles for charging piles show a consistent trend, requiring charging piles to be as close as possible to the following objectives:

(1) Fast charging

Compared with nickel-metal hydride and lithium-ion power batteries with good development prospects, traditional lead-acid batteries have the advantages of mature technology, low cost, large battery capacity, good output characteristics of following load and no memory effect, but also have the problems of low specific energy and short driving distance on a charge.

Therefore, in the current situation that the power battery cannot directly provide more driving range, if the battery charging speed can be realized, the fatal weakness of short driving range of electric vehicles can be solved in a sense.

(2) Charging universalization

Under the market background of the coexistence of multiple types of batteries and multiple voltage levels, charging devices used in public places must have the ability to adapt to multiple types of battery systems and various voltage levels, that is, the charging system should have the charging universality and the charging control algorithm of multiple types of batteries. It can match charging characteristics with different battery systems of all kinds of electric vehicles, and can charge different batteries.

Therefore, in the early stage of ev commercialization, relevant policies and measures should be formulated to regulate the charging interface, charging specification and interface protocol between charging devices used in public places and EV.

(3) Intelligent charging

One of the key problems restricting the development and popularization of electric vehicles is the performance and application level of energy storage batteries. The objective of optimizing the intelligent battery charging method is to realize the lossless battery charging, monitor the discharge state of the battery, avoid the over-discharge phenomenon, so as to extend the service life of the battery and save energy.

The development of intelligent charging application technology is mainly reflected in the following aspects: optimized and intelligent charging technology, charger and charging station; Battery power calculation, guidance and intelligent management; Automatic diagnosis and maintenance of battery faults.

(4) High efficiency of electric energy conversion

The energy consumption index of electric vehicle is closely related to its operating energy cost. It is one of the key factors to promote the industrialization of electric vehicles to reduce the running energy consumption and improve its economy. For charging stations, from the perspective of electric energy conversion efficiency and construction cost, priority should be given to charging devices with high electric energy conversion efficiency and low construction cost.

(5) Charging integration

In line with the subsystem miniaturization and multiple functional requirements, as well as the improvement of reliability and stability, battery charging system and electric energy management system as a whole, integrated transmission transistor, current reverse discharge detection and protection, and other functions, to achieve a smaller need for external components, integration of higher charging solution, Thus, the rest of the electric vehicle components can save the layout space, greatly reduce the system cost, and can optimize the charging effect, prolong the battery life.

|